Using the exchange market data as the main instrument,

Elliott discovered that the ever-changing price configuration of the exchange

market shapes up a certain structured pattern, which describes the fundamental

natural harmony. On this discovery basis, he developed a rational market analysis

system.

Elliott pointed out the movement

patterns or «waves» emerging again and again in the market price movements and

they are self-similar in form, but not always in timeframe and amplitude. He

entitled these models, gave definitions and illustrations. Thereafter, he

described how these structures link together to form a zoomed version of these

models, and then how they link for building up the extended identical models

etc.

To be brief, the Wave Principle -

is a catalogue of price adjustments models and explanations of where is

most likely to see such figures in the market development process. Elliott

classifications represent themselves as a rule set for the market behaviour

explanation. Elliott posited about the prediction significantly of the Wave principle,

which was called after its developer's name.

Essential concepts

The main market cycle motion runs up according to

the structure consisting of a 5-wave sequence, which is corrected by a 3-wave

structure with the opposite direction (pic1).

|

| Рiс. 1. Diagrammatic view of the Wave Principle |

«Enumerated phases» called by R.N. Elliott as «cardinal waves» now known as «impulsive waves». «Sideward phases» nowadays - «corrective waves» or sometimes just «triplets». Wave 2 corrects wave 1; wave 4 corrects wave 3. The full sequence of waves 1-5 is corrected by the a-b-c sequence. Looking at the large scale image the wave sequence 1-5 shapes up a higher level wave. Thus, 1-5 wave movement completes the wave, and, while a-b-c sequence completes the wave or (pic.2).

|

| Pic.2 Schematic wave diagram |

In the microscale each wave at the pic.2 can be divided into small wave components:

- wave 2 corrects the wave 1;

- the wave 4 corrects wave 3;

- a-b-c sequence corrects the sequence of 1-5 waves (pic.3).

|

| Pic.2a The EUR\USD pair graph |

At the pic.2a at the EUR\USD currency pair graph, we can see the Elliott full wave cycle. The main cycle waves are traced with the red line, yellow lines signal small wave components of the main waves.

|

| Pic. 3 Wave fractionation into a small wave components |

There are three rules which are «unbreakable»:

- Wave 2 never turns back ["reverses»] further than wave 1. If the impulsive waves are up-directed, then wave 2 can not slide below the 1 wave's start point (see pic. 4). If the impulse the sequence goes down, the wave 2 can not surge above the peak, from which took It rises the wave 1.

- The wave 3 can not be the shortest among the «impulsive waves» (see pic.5). The wave 3 is not required to be the longest, but it almost always is.

- In the increasing sequence, wave 4 can not step out of the wave 1 peak range. In the falling sequence, the wave 4 rally can not tick above wave 1.

If even one of these rules is broken, the sequence

is not impulsive (pic.6).

Impulsive waves

In one of the waves, a variation may take place,

known as extension. Extension

— is exaggerated or overextended movements, which don't fit into the scale,

compared to other impulse waves. Take into account that extensions can be only

in one of the impulsive waves (in the 1st, 3d or 5th). More often

these extensions occur in the 3d wave. They can also emerge in the extended

wave.

|

| Pic. 7. Sequence from (1) to (5) the wave 3 |

|

| Pic. 8 Sequence from i to v - extended wave (3); it is the part of extended wave 3 |

There is one more impulsive waves variety - diagonal triangle, wedge-shaped structure, formed by two concurrent lines (in their normal form). Such structures may be witnessed in the wave 5 position, usually after a drastic and short-term motion of the previous wave 3. Usually, in such a wedge, the sub-waves have a «triplet» or «quintuplet» form. A crossover between the 1 and 4 wave endings — is also a frequently seen issue. It is the only well-known exception from Elliott's «noncrossing rule» of 1 and 4 waves.

An example is given in the pic.9

Diagonal triangles can also be found in the C wave

position, which is a part of the «sideward phase», i.e. in the corrective

waves. As well as in the case with wedges in the 5 wave position, these formations

signal the movement ends, one level above the considered one.

|

| Pic.9. Wave 5 — diagonal triangle |

Betweentimes, the 5th wave is not able to overcome the previous wave 3 ending level. A concept with this meaning is negatively inspired - «failure». You can make sure of such structure existence if the internal waves of the «failed 5th wave» correspond to all three rules related to the impulse waves. Failure — is a reversal structure, which generated the «double tops» or «double lows» well known in classical chartism. This structure is rarely seen at the «minutes» or «minors», but it is widely spread at the «minutes» (pic.10).

CORRECTIVE WAVES

Movements, directed versus the trend are called

«corrective waves» or just «corrections» (retracements). Sometimes, they are

called «consolidations» or «lateral phase». The only and the most essential rule, which can be conceived

from different corrective patterns examination, is that the rollbacks can never

turn into «quintuplets». Only moving waves are the «quintuplets». For this reason, the starting 5-wave motion against the older wave level is never a

correction end, it is just a part of it.

Correctional processes are carried out

in two ways. Sharp kick-backs bend steeply versus the movement direction of the

older wave level. Although the sideward corrections always carry out the total

rollback from the preceding wave, usually they include a move to its starting

point or even out its bounds range, shaping up a lateral movement facade. The

separate corrective patterns break down into the main categories:

- Flats (3-3-5), (pic.12a-b)

|

| Pic. 12a. Flat Bull correction |

|

| Pic.12b. Flat Bear correction |

- Triangles (3-3-3-3), (pic. 13a-b)

|

| Pic. 13a Triangle Bull correction |

|

| Pic. 13b Triangle Bear correction |

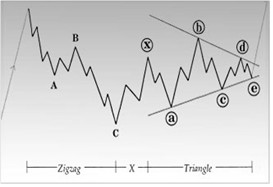

The combination of This standard pattern constructs the 4th category.

- Double triplets and triple triplets (combined structures)

a) Composite corrective forms Double triplets

Flat-complex (pic.14a — e).

|

| Pic. 14c. Zigzag- |-Х-| -Flat correction |

|

| Pic.14d Flat correction- |-Х-| - Flat correction |

b) Composite corrective forms

Triple triplets (pic.15a-d)

|

| Pic.15a. Zigzag-|-Х-|-Zigzag-|-Х-|-Zigzag |

|

| Pic.15b Zigzag-|-Х-|-Flat correction- |-Х-|-Triangle |

|

| Pic.15c. Flat correction-|-Х-|-Zigzag-|-Х-|-Triangle |

|

| Pic.15d. Flat correction-|-Х-|-Flat correction-|-Х-|- Flat correction |

You must have already drawn attention to that the basic patterns in double and triple triplets are linked by wave X, which also turns out to be a triplet (corrective wave) and it may be a flat, zigzag and triangle.

Alternation Principle

Despite its sounding title, the alternation

principle — is exactly a principle, i.e. a valuable norm, but not a changeable rule in the Wave methods. The market experience shows that the principle is

valid during 90% of the time between the

waves 2 and 4 in

5-waves structure.

In the statement made by R.N.Elliott, the principle

requires the alternation in emerging of simple and composite correctional

structures in waves 2 and 4.

A simple deep correction (zigzags, double zigzags) in

the wave 2 must construct a composite sideward

one (flat, triangle, double and triple triplets) in wave 4.

However, in the Forex market, the Alternation principle

is rightful mostly concerning the extent, not the structure of the

corrections. For instance, if wave 2 rolls back by 61.8% or more from wave 1,

most likely that wave 4 would pull back by 38.2% or less from wave 3.

If wave 2 rushes back by 38.2% from wave 1, then

wave 4 will correct wave 3 by 23.6% or 50%. The opportunity of structure

alternation still remains, but from time to time there may emerge significant

exceptions. More often, the alternation

process comes about the extension or deepness of the corrections, rather than

about their structures and forms.

This principle also requires us to look for

different formations in double and triple triplets. In the double

triplet the most commonly used structure is a flat correction or zigzag.

If the triangle is shaping up, it almost always appears to be the last

structure in the correctional phase.

Two sequent flat corrections signal that

there will be the third one, ordinary — a triangle. A triple triplet may be

constructed from three flat corrections. The Theory reqiues to search in the

triangle different structures in tangent and integral subwaves. Subwave A is

not similar to subwave B; subwave B

differs from subwave C etc.

FIBONACCI RELATIONSHIPS

Elliott noticed in his work «Nature's Law» that

Fibonacci sequence is a small basis of the Wave Principle. Here are Fibonacci

figures: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610 etc.

The sum of any two neighbor figures is equal to the next figure in the

sequence. Example: 3 + 5 = 8; 5 + 8 = 13; 8 + 13 = 21; 13 + 21 = 34 etc.

Dividing of Fibonacci figure by the neighboring lesser one gives 1.618.

Example: 34/21=1.618. Further, the same

Fibonacci figure dividing by the next one gives 0.618. Example: 34/55 =

0.618. The figure opposite to 1.618 is

equal to 0.618.

Likewise, the contrary to 0.618 is 1.618. Example: 1 /0.618 =

1.618, и 1 / 1.618 = 0.618.

Dividing of any Fibonacci figure by the previous one by two positions in the

sequence increases the result to 2.618.

And this figure dividing by the next one, which is in two positions from

it in the sequence, amounts to 0.382.

Example: 55/144 = 0.382. A contrary

figure to 2.618 is 0.382, and the figure opposite to the proportion 0.382 is 2.618. Example: 1 /2.618 = 0.382; 1 /

0.382 = 2.618. Any Fibonacci figure dividing

by the figure which is 3 positions before it, gives 4.236. Example:

144/34 = 4.236. And the same figure diividing by the next one, 3 positions away

from it in the sequence, gives a reading of 0.236. Example: 144/610 = 0.236.

The opposite figure to 4.236 is equal to 0.236, and the figure opposite to the

proportion 0.236 is 4.236. Example: 1 /4.236 = 0.236; 1 / 0.236 = 4.236. A

proportion which equals to 1 (par) shows

the equality relation between first two

figures in the Fibonacci sequence; thus, 1/1 = 1. Relation 0.5 appears as the

second and third figures ratio in the sequence, therefore, 1/2 = 0.5.

Fibonacci figures don't have any value during the

market movements «extension» forecast regarding the absolute price value. The

key elements — relations between the sequence figures. More frequently and

reliable the Fibonacci figures can be seen between the alternating waves,

rather than between the neighboring.

As an example, the wave 3 length in the

5-wave structure is influenced mostly by the wave 1 length, rather than the

wave 2 length. The target orientators counted by means of Fibonacci

relationships usually turn out to be essential support or resistance levels,

even if after that follows their break through.

An important addition to

Elliott Wave Principle appears to be a comprehension that

Fibonacci proportions are the «initial determinants», measuring the price

«duration» through time in the market. Elliott Wave Principle provides us the

form and structure and Fibonacci relationships give an instrument for measuring

any price movement potential, including the limits of possible finishing

date of these movements. This a very powerful combination.

Let us look through more detailed how Fibonacci

ratios behave during the wave formation.

Impulse waves

The ending point of wave 3 — the hardest to

predict, compared to three impulse waves. As the 3rd wave may be shorter than

the 1st one (rather seldom), then its closing forecast — is a real trap for an imprudent analyst.

If it is shorter than wave 1, wave 3 may equal to

wave 1 or be longer by 1.618. In case of extensions, wave 3 may be longer even

by 2.618 and 4.236 than wave 1. The length of wave 5 can be obtained by means of

Fibo ratios, used for price movement between the opening of wave 1 and closing

of wave 3.

Extensions

In each 5-wave structure worth taking into account

that only one from the impulse waves (1st, 3d or 5th) will be

extended. If wave 3 is extended, then waves 1 and 5 have the equality tendency

on a price distance or equality tendency on movement length from the opening

point to the closing one.

In case of extension the middle of «wave 3 within

wave 3» usually points at the central point of all wave 3 movement. A

mysterious thing as extension still remains one of the least clear matter in

the Wave Principle. If we see a serie of overlapping waves in such wave

structure point, where is not considered a presence of horizontal and diagonal

triangles — usually it is an extension.

In Forex markets about 60% of extensions appear in three forms. Extended

5th waves can occur in 35% and left 5% - extended 1st

waves. If an extended wave is found in the first 5-wave structure, so the next

correction of all structure should be expected around wave 2, instead of

regular wave 4 range. It is especially correct in case when wave 5 is much less

than wave 3 in

the sequence.

Within the extensions the corrections are smoother.

A normal percentage of reversal against the previous wave is – 23.6%; the

corrections rarely exceed 38.2%. If wave 2 pulls back from the 1st

one less than by 50%, most probable is that wave 3 will be extended. Such

tendency becomes more possible if wave 2 structure is similar to flat and

irregular correction.

If wave 5

in any 5-wave structrure is extended, then about 80% of

cases this structure is wave 3

in larger formation. If wave 5 is extended — its length

is often bigger by 1.618 than the full

price distance between the wave 3 opening point and wave 3 peak. See the

picture below:

Methods used during the predictive modeling of

corrective waves deepness according to the Elliott Wave Principle may be

various, though the main approach to applies to multiplication of Fibo ratios

0.236, 0.382, 0.5 и 0.618 by the preceding impulse wave length.

The corrections have an inclination to price

reversion to the range of the previous wave 4, at lower rate — frequently, a

little bit further than its extremum. Elliott named 8 types of correctional

structures and found out that they can double or triple in the long-term lateral consolidations.

A double triplet —

the most complicated correctional structure within the Wave Principle. That is

almost the one and the most widespread reason for mistakes in the forecasts and

temporary targets. (pic.a — f). The double triplets are not frequently occured

in higher rate waves, however, it is not a rarity at 1-hour and 10-minutes

chats.

If the correction starts from a compound sideward structure (flat

correction or triangle), then the rollback from the dominating impulse trend

usually confines itself to the deepness of

38.2% or at the very outside - 50%. Generally, it is correct even if

this correction is wave 2. A

correction, which doesn't run beyond

38.2% of the previous motion signals the restraining power of the major trend.

Identically, a consolidation, requiring

time for closing, it is a curtain-raiser prior to the crush, which will take

place after the correctional structure ending. 50%-corrections in the 5-wave structures

— is an everyday occurence, but they happen not so often as 61.8%-corrections.

But 50%-corrections are frequent seen in the Rally internal waves taking place

in the bear market, i.e. inside the wave B in the zigzag. The end of zigzag

doesn't guarantee that the whole retracement has finished, as the «rollback»

forms may contain complicated structures.

But the analyst has to follow the

most straightforward explanation of completed structure. R.N.Elliott also

affirmed that the most simple structure often appears to be a correct

interpretation. Elliott did not try to give exact prediction rules for longer

correctional structures.

In «double zigzag» structures the secong zigzag must

close significantly lower than the bottom bound of the first one (in the bull

market). And, on the contrary, in the

falling market the second zigzag must close much higher than the first zigzag

peak.

The Wave Principle doesn't give an opportunity to

predict the wave 2 ending point. Unfortunately, even reliable Fibo ratios are useless.

Hereby, Elliott can offer only verisimilar points, where can be put the Stop

levels. That is why it's better to avoid trading in the second waves.

Oftener,

the second waves are simple (zigzag, double zigzag), and the fourth waves — are

complicated (flat retracement, irregular correction, triangles, double or

triple triplets etc.). Wave 2 usually «pulls back» deeper than the 4th

one. Wave 2 has a rollback trend to 61.8% or furhter against wave 1.

If that

does not happen — the next most likely reading is 50%. The most typical

rollback deepness of wave 4 equals to 38.2% from wave 3. In case of wave 5

«failure», can be expected that the next deepness retracement

will turn out to be the most possible for a

correctional structure.

|

| Pic.17 demonstrates a typical rollback deepness of wave 2 |

|

| Pic.18 demonstrates a typical rollback deepness of wave 4 |

Fibonacci correction levels are counstructed as follows. First of all, between two extreme points is traced out the trend line — for example, from the bay to the opposite top. After that, are designed 9 horizontal lines, crossing the trend line at Fibonacci levels: 0,0%, 23,6%, 38,2%, 50%, 61.8%, 100%, 161,8%, 261,8% и 423,6%. (Due to selected scale some of these lines may not fit at the graph).

After a strong rise or fall the prices often

reverse back, correcting a huge part of its origin movement. During such

reversal motion the prices frequently meet the support/resistance at Fibonacci

correction levels or around them.

Fibonacci proportions comprehension: the first

pullback level (23.6%) is usually insignificant, the next level (38.2%) - as a

rule, it is a substantial level, the market rolls back from it almost all the

timel; if the market reversal goes on afterwards — the next essential

consolidation level will be at 50%, and the pullback continuation to 61.8%

usually signals a final closing of the preceding trend.

Lessons:

- Operations With Trader Platform On The Basis Of Meta Trader 4

- Wave Analysis. Elliott Wave Principle