Considering the market analysis from a technical aspect a trend appears to be a key concept. All the

analysis and assessment toolkits used by an analyst: support and resistance

levels, price models, moving averages, trend bounds etc. are destined to carry

out the one extra task.

Using these facilities the analyst defines and estimates

the trend to follow during further trading. All of us faced the epigrams

such as: “trade only within the trend”, “never go against the tendency”, “trend

– is your best friend”. Last lectures we were discussing a trending concept, so

let us give a definition of the trend and classify it into several categories.

Broadly speaking, a trend

or a tendency – is a movement direction of the market. Above all, in a real-life

any market does not move along a straight line. The market dynamics looks like a

zigzag course resembling a wave succession: rise and fall, rise and fall. These

dynamics fluctuations set up the market trend.

The dynamic direction of

these increases and declines with the ascending, descending or horizontal

trends show the market tendency behaviour. So, if every sequent tick up or down

is lower than the previous one it is a descending trend. If these adjustments

remain at the same level – a horizontal tendency. (see the pic. 4.1 a-d).

|

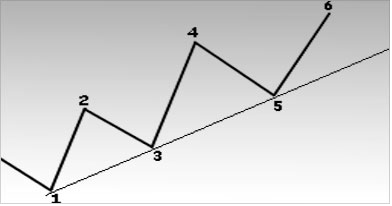

| Pic. 4.1a |

Pic. 4. 1a. Example of a rising trend with the

ascending peaks and recessions.

|

| Pic. 4.1b |

Pic. 4.1b. Example of a descending trend with the decreasing peaks and downturns.

|

| Pic. 4.1c |

Pic. 4.1c. Example of a horizontal tendency, when the top and bottom lines are at one level.

Such market is often

called trendless.

|

| Pic. 4.1 d |

Pic. 4.1 d. On the left side of the graph we can see the growing trend representation, on the top – a flat-dipping line and decreasing movement on the right.

A trend has three directions

It is no coincidence that

we have introduced the following concepts: ascending, descending and flat

moving trends. A great many people suppose that the market follows one

certain line – increasing or decreasing.

But in actual fact, the market moves

in three directions: up, down or remains in a holding pattern. This must be well-learned, as according to the conservative estimates, about one-third of

all time is spent on bottom-up adjustments when the peaks and recessions stay

approximately in the same range.

This model of horizontal price movement is

called “trading or market range”. Such vibrations show the equilibrium price

period when the supply and demand ratio is almost changeless. For a technical

analyst, this kind of market turns out to be a trap.

Most technical

instruments and systems are oriented to the tendency, in other words, they are

focused on how the market moves – upwards or downwards. In a trendless mode, they become inefficient or out of work at all.

Especially these “sticky”

periods of a flat market bring a lot of disappointments for the technical

system traders, resulting in significant losses. For efficiency of the trend following system, first of all, there must be a trend.

So the seat of

the trouble is not in the system, but in the trader trying to use it under the conditions

not suitable for this system. Each trader, operating in the financial market,

has three options: buy (take up a long

term position), sell (short term position) or do nothing (wait). If the market

goes up, it’s better to buy. If down-sell.

But if the market is

flat, trendless, the most reasonable decision would be not to undertake

anything.

Three trend types

In addition to that, a tendency can follow the three scenarios mentioned above, it can also come in three

forms: the long-term, mid-term and short-term (or small). Actually, the

quantity of trends operating and crossing

each other is almost endless.

There are some trends able to exist just a few

minutes, as well as those which can last several hours, but there are also

supergiants – the existence period can continue 50 or even 100 years. However, most chartists are inclined to the traditional classification and

distinguish three tendency types, although, one term does not include the same

concepts

For instance, the DowTheory determines the main trend as existing after 1 year. But, due to that, the

traders operate with much shorter timelines, the main market trend is

that which holds on not less than half a year. According to Dow’s

definition, a mid-term tendency lasts from 3 weeks to 3 months. And a small or

short-term trend – more than 2-3 weeks.

Each type appears to be a

part of another one, a larger trend. For example, a mid-term tendency represents

a correction or adjustment against the larger one. Amid a long-term rising

trend, the market can switch to a holding pattern to adjust the situation for

a couple of months.

This mid-term correction in its turn will involve a range

of shorter rises and falls. And all this goes around and around. A tendency is

some kind of a nested doll (Matryoshka), on one hand, it is a part of another

larger trend, but it also contains some small elements (see pic. 4.2 a and b).

|

| Pic.4.2 a |

Pic.4.2 an Example of three tendency types: long-term, mid-term and short-term. Points 1, 2, 3 and 4 signal the long-term ascending trend. Wave 2-3 represents a mid-term correction within the long term one. In its turn, each mid-term (secondary) wave divides into smaller short-term trends. For example, the mid-term wave 2-3 consists of smaller waves А-В-С.

At the pic.4.2 a the long

term tendency is up-directed, as the highs and lows are rising (points 1, 2, 3,

4). The correction phase (section 2-3) is a mid-term adjustment of the long-term

rising trend. But pay attention to that the wave 2-3 divides into 3 smaller

waves (А, В и С).

At point C, an analyst can conclude that the long-term

tendency continues going up, however, the mid-term and small trends are

descending at this time. At point 4, all three tendencies will be ascending.

It’s necessary to get clear the difference between the three trend types.

In case,

somebody asks which is the current market tendency, it’s essential to find out

which one he bears in mind before answering. Most likely that answering this question you will have to apply to the above-mentioned classification and describe

each of the three tendencies operating in the market at that time.

As a rule,

the most analytical approaches, acting amid the trends of the financial

markets are mostly oriented to the mid-term tendency, which can last several

months. Small or short-term trends are usually used for defining a certain

moment of opening or closing the positions.

Let us say if the mid-term

tendency ticks up, the short-term drop can be used for taking a long position. If

however, the mid-term tendency goes down the short-term jump can be useful for

taking a short position.

Earlier, we frequently

noticed that a price movement is a range of surges and slashes, and their

direction determines the market trend. Now, let us entitle these upward and

downward movements. Thus, there will be the concepts of “support” and

“resistance”.

The previous decline levels are called support. As it comes out

from the book name, support – is a level or zone at the graph below the market

rate, where the purchase ambition is rather high and can stand against the dealer’s pressure.

As a consequence, the pace of decrease is slower and the prices are rising up

again.

Ordinary, the support

level can be defined in advance by analyzing the previous drop. At the picture

4.3а the points 2 and 4 are in line with the support levels amid the ascending

trend (see the pic. 4.3а and b).

|

| Pic 4.3 a |

Pic. 4.3a. The graph is depicted the support and resistance levels growing amid the rising tendency. The points 2 and 4 – are the support levels, usually, they match together with the previous downturns. Points 1 and 3 – are the resistance levels, which used to come in line with the preceding peaks.

Resistance – is the

opposite of support, above market rate level, where the sellers’ pressure

overbears the buyers’ one. In consequence, the price growth eases and

interchanges to a decrease.

Usually, the

resistance level comes in line with the previous top. At the pic. 4.3а points 1 and 3 fits with the resistance levels. Here is illustrated the

ascending trend chat, where the support and resistance levels are rising.

Pic.4.3b shows the

down-going tendency graph, where the rises and falls are down-directed. In this

case, points 1 and 3 turns out to be the support levels, 2 and 4 – the

resistance levels.

If the tendency moves up,

the resistance levels signal the intervals during the development period, at a

certain stage it is possible to overcome these levels and advance further.

If the tendency goes

down, the support levels can not stop the price lowering, but it is able to

hold it for a while.

To understand the core of

the “tendency” concept it is essential to puzzle out the support and resistance

terms. To say that the rising trend continues it is necessary for each sequent

recession (support level) be higher than the previous one.

Consequently, each

next peak (resistance level) must be higher too. If a correction drop touches

the previous rate, it may be the first sign of a possible ascending trend finish

or switch from a rising tendency to a flat one. If the prices manage to

surmount the support levels, the changeover from ascending to descending

movement becomes most probable.

|

| Pic.4.4a |

Pic.4.4a Example of reversal in the tendency dynamics. In point 5 the prices did not overcome the previous maximum 3 and moved lower the preceding decline 4. This signals a changeover to a downside trend. Such kind of model is called “double top”.

|

| Pic.4.4b |

Pic.4.4b Example of a downward trend reversal. Usually, the first sign that the prices have reached their bottom limit appears to be their ability to fix in the point 5 above the previous fall rate 3. The next price outbreak above the top 4 confirms the descending trend closing.

|

| Pic.4.4 c |

Pic.4.4 c Classical example of a down-going trend reversal. Try to memorize this picture, because we will return to it in the next lecture while studying the price models.

Each time the preceding

resistance peak goes through testing, its outcome can turn out to be a verdict

or diagnosis for the upside trend. If the prices are not able to overbear the last spike amid the rising motion or the last low on the downside, it may be

concluded that the current trend adjustment will take place soon.

In the next

lesson concerned with the price models, we will demonstrate how after a retest of support and resistance

levels at the chats appear the certain configurations signalling about the

tendency reversal or about a break in its movement.

At the pic.4.4 a-c

illustrated the classical examples of reversal in the trend dynamics. Pay

attention that at the graph, at the pic.4.4a in point 5 the prices did not

manage to overcome the previous spike 3 and then fell below the last drop

(point 4). In this case, the reversal in the trend dynamics can be determined

by monitoring the support and resistance levels.

How the support and

resistance levels vary in the roles.

Up to now a term

“support” used to mean the previous low and “resistance” – the previous high.

However, it’s not always like that. We have approached one of the most

interesting and least known aspects of support and resistance, consisting in

that they can change the roles with each other.

Each time when the support or resistance

outbreaks significantly, they vary the roles – that is to say, they turn out to

be an opposition of themselves. In other words, the resistance level becomes

the support and inversely.

To conceive this transformation mechanism we have to

apply to the elements creating the support and resistance levels, to the psychological aspect of these concepts.

Psychology of support

and resistance

For more

demonstrativeness let us classify all the market participants into three

categories: those, who take the long positions, who take the short positions

and so-called “unjoined”.

The long positions take those who had already bought.

“Unjoined” – the traders, who had left the market closing all the positions or

those who had not decided yet how to enter the market and which side to take

up.

So, let us imagine that

somewhile, the prices were wobbling around the support range, then the market

began to advance upwards. The part of “long” players, those who bought at

support level prices are exulting but regretting at the same time that they

did not buy more.

Say, good, but it is not enough. If the market could follow

the previous support level and slip a little bit lower, they could buy much

more. The part of “short” players

recognized at last (or beginning to recognize) that their tactics were wrong

(the extent of their pessimism is directly proportional to how far is the

market from the support level, we will return to this later).

The most desirable for them is the market to

go down to the level, at which they took a short position, in order to leave

the market exactly at that point where they entered (this is a so-called

breakeven point).

Those who are in the

“holding pattern” can be also divided into two groups: the first group of traders

did not take any positions, others closed their long positions in the support

level zone. The last-mentioned kick themselves now, because they rushed with

the sale and looking for a chance to open the long positions at the selling

price.

For all of

they, the support level below the market rate is a “priority №1”. So, needless

to say, that, if the prices spike down to that level – a recovered stampede

striving to buy would boost the prices again and they would run upwards.

The higher is the

trading activity in the support range, the more essential becomes this area, as

more participants are materially interested in it. The trading activity level

can be defined in the support or resistance zone by three methods: according to

the timeframe during which the prices were in that range, to the trading volume

and the existence time of this area.

The more long is the time

period within which the prices were fluctuating around the support and

resistance, the more important becomes this band.

For example, if in a certain range of flatness, the prices were wobbling bottom-up during three

weeks and then moved upwards, then this support band is more crucial in

comparison with the similar fluctuations within a 3-day period.

One more relevance

indicator of support and resistance is its time remoteness from the present

moment. So far as we are dealing with the traders respond to the market

behaviour and the positions, which they had already taken or had not succeeded

to do it yet, it is clear that the more soon will take place event and

reaction to it, the more notable would be this event by itself.

Now let us consider an

opposite situation. Suppose that instead of going up, the prices slumped. In

the previous example, the prices were rising, so all the market participants

began to buy during each correctional fall (setting up the new support levels).

However, if the prices slide down and stay below the support rate, the response

of the market participants will change in the quite opposite way. All who was

buying at the support rate clearly realize what a stupidity they have made.

Finally, their brokers will frantically start requiring additional

collateral. Due to that in the dealing process appears so-called “lever

effect”, a trader can not blame itself for losses too long. He just has to

increase the collateral or cancel the lossmaking position.

What was the example of

the support level shaping? The purchase orders are below the market rate. And

now all the previous purchase orders turned out to be the sale orders above the

market rate. In such a way, the support evolved into resistance.

And,

consequently, the more essential was the previous support level or the more

close it was to the present moment and depending on the deals quantity, the

more important will be the resistance level.

All the factors which contributed

the support level formation by the efforts of three categories market

participants – “long players”, “short players” and “unjoined”, now will aim to

set a top for the future surges and price rally.

After been overcome

significantly the support level turns out to be a resistance and inversely. The

pictures 4.5a-care very similarly to 4.3 a ,b, except for one detail. Pay attention, at

the pic.4.5a in the rising trend process the action in point 4 stops at the

peak 1 or slightly higher.

Thus, the previous resistance level (peak 1) turns

into support, as wave 3 overcame it significantly. All the sales of the

wave 3 range (forming the resistance level) transform into purchases below

the market rate.

The pic.4.5b show that the market prices drift down. The point

1 (the former support level below the market rate) becomes a resistance above

the market rate i.e. begins to play the role of a “price cap” (point 4).

|

| Pic.4.5a |

Pic.4.5a. Following the upturn trend, the resistance level changes into support after been jumped over by a large amount. Pay attention to that when the resistance had been exceeded in point 1, it turned into support. The preceding highs act as a part of support amid the next corrections.

|

| Pic.4.5b |

Pic.4.5b. Following the downturn trend the support level, after its breakthrough, transforms into resistance for the future price pickups. Bring to notice the way how the previous support (point 1) becomes a resistance (point 4).

As it was noticed

earlier, the prices move size from the resistance or support increases these

levels’ value. Especially, when the

prices overbear the support or resistance, and they change their roles with each other.

For example, we discussed that they do it only in case the prices overcome this

range by a significant extent. But what exactly should be considered as a

“significant” extent? In this case, the estimate will be rather subjective.

As

a significance test, most analysts use the 10% price outbreak, particularly,

for the support and resistance of the main tendency. If the question is in the

support and resistance of a shorter trend, then the outbreak size is required to

lower to 3-5 %. Practically, each analyst must decide what exactly he will

consider as a significant outbreak amount.

Therein it is necessary

to remember that support and resistance exchange their roles only in case the

market adjustments are rather significant so that the players could assure

themselves that they have made a mistake, the more far moves the market, the

more clear they realize their slippage.

|

| Pic. 4.5c |

Pic. 4.5c Pay attention to how the support which was laying off the market all May becomes a resistance barrier in June. Support turns into resistance.

Trend lines

Now when we have puzzled

out the support and resistance, it is time to include in our technical

instruments arsenal one more element – a trend line (see the pic.4.6a,c).

The main trend line

represents one of the most simple technical instruments used in the graphical analysis. But despite its simplicity, it is an extremely valuable item for futures market analysts.

Rising trend line – is a right line traced out upwards

from left to right through the sequent rising fall points. In pic.4.6a it

is depicted as a continuous straight line.

|

| Pic.4.6a |

Pic.4.6a Example of the rising trend line. Rising the trend line is depicted under sequent rising fall points. Therein, a trial trend the line may be traced through two fall points, one of which is higher (points 1 and 3), but for this line validity confirmation, the third line is required (point 5).

The downward trend line is

traced down from left to right and passes through sequent lowering peaks (see

the pic.4.6b).

|

| Pic.4.6b |

Pic.4.6b. The downward trend line is traced above sequent descending peaks. An experiential trend line can be constructed with two points (1 and 3), but it will be considered as veridical after there will be three such points (point 5).

Trend line construction

As with any aspect of

graphical analysis, trend line designing – is some kind of skill. Usually,

to trace out the right line you have to practise a little bit and construct it

several times. Here are some handy tips to find out the right line. First of

all, there must be trend occurrence

signs.

This means that to design an ascending trend line, at least 2 slumps are

required, the second drop must be higher than the first one. Obviously, to

build up the right line you will need two points. For instance, you can confidently

say about the upside trend at the pic.4.6a only after the price dip will stop in point 3 (higher fall), and the prices continue advancing.

Only after that is

possible to trace out a sample trend line under points 1 and 3. Some

analysts prefer to wait for the prices to overcome the peak 2 levels in the next

upturn period for the ascending trend affirmation, and then the line is

constructed.

Others are satisfied that the upturn area touches half of

the 2-3 leg distance or reaches the peak 2 range. As it is seen, the criteria

can be different, however, it is essential to remember one thing: each analyst

wants to be sure that the intermediate price dip is over and he can mark the

real downturn point.

After two sequent fall points are marked on the graph,

where the next going point is higher than the previous one, they are connected

with a straight line traced out from left to right. For confirmation of the

sample trend line validity the prices have to touch it for the third time, and

starting out from there move upwards.

How to use the trend line

Let us say, we are

dealing with the up-going tone. In this case, inevitable correctional or

mid-term recessions will take on very close to the upside trend line or be

tangent to it.

As amid the rising trend, a trader relies on buying at the

declines, the trend line may serve as support bound below the market rate,

which can be used as a purchase zone. If the tone is down-going the trend line

can be used as a resistance level for sale.

Currently, there is no

reversal in the trend line dynamics, it can serve for purchase and sale zones

determination. But in point 9 at the pic.4.7a and 4.7b, such reversal takes

place. This signals that all the positions opened in the previous trend

direction must be liquidated. Oftentimes, the trend line outbreak – is the

first reversal signal in the tendency behaviour.

|

| Pic.4.7a |

Pic.4.7a As soon as the rising trend line is set up, the next drops reaching the line can be useful as purchase ranges. Points 5 and 7 at this graph can serve for opening the new or additional long positions. The trend line outbreak in point 9 proves the reversal in the trend behaviour: probably, it moves downwards. That is why it is necessary to cancel all long positions in point 9.

Pic. 4.7b Points 5 and 7 can be used as a sale

zone. The trend line outbreak (point 9) signals about possible trend reversal

increase.

How to determine the

trend line meaningfulness?

Let us puzzle out some

nuances of the trend line practical usage. Above all, you need to find out what

defines this line significantly? The answer is dual: on one hand, the trend line

meaningfulness depends on its validity period, on the other hand, how many

times it was tested.

If, for example, the trend line stands 8 tests, each of

which has confirmed its validity, undoubtedly, it is more significant, than a

line, which was touched by the price only three times.

Aside from this, the

line which was asserting its validity during 9 months, is much more important

than that which existed for about 9 weeks or days. The more high is the trend

validity, the more reliable it is, as well as its outbreak.

How to deal with

low-level outbreaks of trend lines?

Between times, during the day the prices break through the trend line, but by the closing moment, everything resumes its natural course. So, that is a dilemma for the analyst: if

there was an outbreak? (see pic.4.8).

Is it necessary to trace out a new

trend line in reference to new data, if a slight breakdown of the trend line

was just short-gap or stochastic? Pic. 4.9 is demonstrated exactly this

situation.

Within the day the prices dipped below the upward trend line, but

they turned out to be above it by the closing. Is the trend line needs to be designed

again in this case?

Unfortunately, it is next

to impossible to give certain advice for all of life's emergencies.

Sometimes, you may set aside such breakout, especially, if the further market

movement approves the initial trend line validity.

In some cases, a compromise

is required, when an analyst traces a new sampling trend line which is designed

as a dotted line in addition to the first one (see the pic.4.8). In this case,

two lines at once are at the analyst’s disposal: original (solid) and the new

one (dotted).

As a rule, the experience shows that if the trend line outbreak

is relatively insignificant and takes place within one day, and by the closing the moment the prices level off and reach the reading above the trend line, then

the analyst can neglect this blowout and continue using the initial trend line.

As in many other market

analysis fields, here it is better to rely on experience and intuition. In such

disputable points – they will be your best advisors.

|

| Pic. 4.8 |

Pic. 4.8 Sometimes, the trend line runout within one day makes a dilemma for the analyst: if to keep the initial trend line, which is still valid or to trace out a new one? A compromise would-be, amid which the first trend line remains, but at the graph, the new line is designed as a dotted one. Time will show which is the most correct.

The trend lines reshape

themselves

It was mentioned earlier

that after a breakthrough the support and resistance change into their

opposite. The same is with the trend lines (see the pic.4.9 a-c). In other

words, the up-going trend line (support line) turns into resistance after the substantial breakout. The downside trend line (resistance line) in its turn may

become support after runout. That is why, in the graphs, it is strongly

recommended to prolong all the trend lines from left to right as much as

possible, even if they are overcome. It is amazing how the old trend lines

appear as the support or resistance lines in future, but already as the

opposite items.

|

| Pic. 4.9a |

Pic. 4.9a Sample of how the up-going support line becomes a resistance. Usually, the support line turns into a barrier resistance for future spikes after a clear breakdown.

|

| Pic.4.9c |

Pic.4.9c Pay attention that the most downside trend line becomes support after a breakout and upward reversal.

How to correct the trend

lines?

From time to time, the

trend lines need to be corrected in accordance with the trend improvement pace

adjustments: if it goes faster or slower (see the pic.4.10 and 4.11). Take our

previous example: if the trend line is overborne it is necessary to trace out a new one, flatter.

If vice-versa, the line is too flat – it is necessary to

redraw it under the steeper slope. Pic. 4.10 displays the situation, amid which

a breakthrough of the abrupt trend line (line 1) led to the necessity to shape up

a new flatter line (line 2). At the pic.4.11, on the contrary, the primal trend

line is very flat (line 1), so a new one has to be depicted under a steeper slope

(line 2).

The rising trend pace accelerated, demanding the more rapid trend

line. A trend line, which is too far from the real price movement configuration

in the market, has no value for the tendency analysis.

|

| Pic.4.10 |

If we are dealing with

the accelerating tendency, at the graph, may emerge several trend lines with a steady growing inclination angle. In such cases, some analysts use bent trend

lines.

However, as a matter of experience, it is known that if there arises a necessity in sharper trend lines, it is better to switch to another instrument

– moving average, which represents itself a curvilinear trend line.

The advantage of access

to different technical indicators is that you are always able to choose the

most suitable one for that certain situation. All methods of technical

analysis can work better or worse depending on the conditions.

If a Technical Analyst has a total toolbar he will select the most effective and useful instrument for a certain moment. A tendency of advancing development pace – is

that occasion when the moving average is more convenient than a range of trend

lines with the bigger angle of slope.

Pic. 4. 11 Example of the too flat upcast trend

line (line 1). Line 1 happened to be extremely flat or slow, while the

improvement pace quickened. In this case, you need to trace out a new sharper

trend line, which would be more corresponding to the advancing tendency.

The channel line

A channel line or return

line can serve as one more example of trend line employment. Sometimes the prices

fluctuate in the ranges, bounded by two parallel lines: the main trend line and

channel line. Of course, if the technical analyst manages to discern a similar

channel occurrence, he will turn to the advantage of this information.

The trend line construction

doesn’t represent an extra complexity. If we have to do with the rising trend

(see the pic.4.12a), above all, it is needful to design the main growing trend

line. It will pass through the fall points. Afterwards, we depict the dotted

line, which is parallel to the major increasing trend line.

The dashed line

gets through the first significant-top point (point 2). Both lines go

bottom-up from left to right forming a channel. If during the next upturn the

prices touch the channel line and jumping from it, decrease again, that means

that the channel possibly exists (point 4).

If during a decline the prices dip

to the original trend line level (point 5), the probability of channel occurrence

increases. All said earlier can be referred to as the descending motion (see the

pic.4.12 b), but certainly quite opposite.

|

| Pic.4.12a |

|

| Pic.4.12b |

|

| Pic. 4.12c |

The main up-going trend line may be useful for the opening of the long position. The channel line can serve as an orientation point to make a profit within the short term operations. The traders, inclined to risk, can use the channel line to open the short positions in direction, opposite to the main tendency, although playing against a dominative trend is always dangerous and, as a rule, unprofitable.

As well as in a case with

the key trend line, the longer stands the channel and the more there are

checking points, the more essential and reliable becomes this channel.

The main trend line

outbreak is always a reversal approval in the tendency behaviour. However, the

ascending trend line outbreak has exactly the opposite reading and shows the

precipitation of existing tendency dynamics. A great many traders consider

the upper bound breakthrough during the upward trend as a signal to open

additional long positions.

The channel can be

helpful for the tendency strength estimation. If the fluctuations don’t reach

the channel line bounds - that means that the movement is down-directed.

In pic.4.13 it can be seen that at the moment when the prices did not manage to

touch the top channel edge (point 5), a trader can draw a conclusion about the coming to the breakup of the tendency. For the time being, it’s just a caution, but as likely

as not, that the second line (the base up-going trend line) will be also broken

through.

The practice shows that if the price adjustments within the certain channel did not succeed to reach one of its bounds, then this is a frank

characteristic of the trend behaviour changing, approving that apparently, a

breakthrough of the opposite channel bound won’t be long in coming.

|

| Pic.4.13 |

The channel can serve for

the base trend line correction (see pic.4.14 and 4.15). If the prices

outstep significantly from the upper channel boundary it signals that the

motion strengthens. Thereat, most analysts trace out a steeper rising trend

line.

It is stretched from the last fall upwards, in parallel to the new channel line (see pic.4.14). Frequently, a sharper support line is more efficient in practical

work, than the old one, which is flatter. The same can be concluded regarding

the reversed situation.

Let us assume that within the upside trend the spike

could not climb to the upper channel edge. That means that you have to design a

new support line from the last drop point, in parallel to the new resistance

line, which connects two last upticks (see the pic.4.15).

The channel lines also

serve the purpose of price targets determination. After a step out from the

existing price channel, as a rule, the prices pass a distance equal to the

channel width. Thus, the user just has to measure the channel width and then

project this size from the point of any trend line breakthrough.

|

| Pic.4.14 |

Pic.4.14 After a breakthrough of the upper channel boundary (wave 5) the most analysts shape up a new growing trend line, parallel to the new top channel line. Put it differently, the line 4-6 is traced out in parallel to the line 3-5. As the upward direction dynamics gathers their pace, small wonder that the main upside trend line is to be sharper.

|

| Pic.4.15 |

Pic.4.15 If the prices do not manage to amount to the upper channel bound and the descending trend line is traced through two sequent down-going peaks (line 3-5), then it is possible to construct a probationary channel line. It will take its rise from the fall point 4 alongside the lines 3-5. At times, this ground channel line is employed as an initial support level for the new tendency.

Though, it must be borne

in mind that among these two lines, the main trend line is always the most essential

and reliable one. Compared to it the channel line plays a small part. Despite

this fact, the channel line usage can often be rather effective, and it is

worth including it in the toolbar of the technical analyst.

Lessons: